Non-Custodial vs Custodial Wallets: how it works?

Non-Custodial vs Custodial Wallets: how it works?

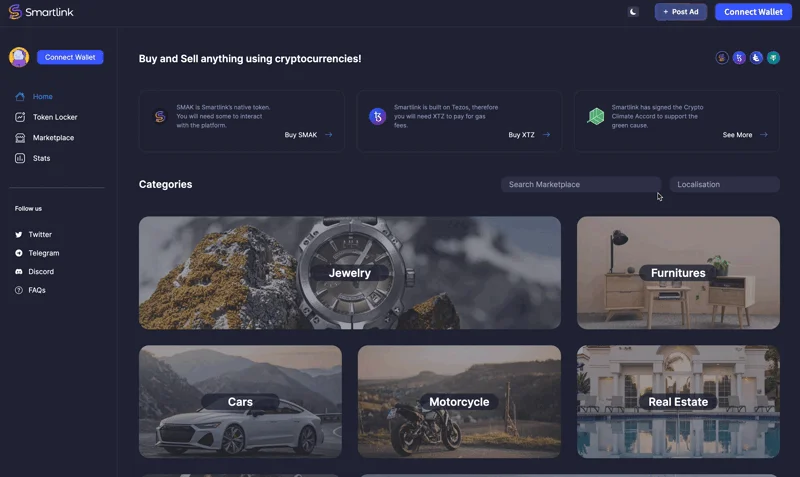

Smartlink

Trust-as-a-Service for the global marketplace

Choosing between non-custodial vs custodial wallets is a pivotal decision for any crypto enthusiast. Smartlink breaks down the intricacies, offering a clear-cut comparison that places you firmly in the driver’s seat of your cryptocurrency journey. We unravel the layers of security, control, and convenience that define these two wallet types.

Whether you prioritize full autonomy over your funds or the ease of a third-party managed system, understanding the distinct advantages and drawbacks is crucial. Immerse yourself in our analysis to make an informed choice that aligns with your personal investment philosophy.

Understanding Wallet Custodianship: The Core Differences

When it comes to managing digital assets, the choice between Non-Custodial Wallets vs Custodial Wallets: Definition is a pivotal decision for cryptocurrency users.

Each type of wallet offers a different level of control, security, and convenience. Here we dissect the main distinctions to empower users with knowledge to choose wisely.

Non-Custodial Wallets vs Custodial Wallets: Definition and Ownership

In the spectrum of crypto wallets, ownership is a key differentiator. Non-custodial wallets provide the user complete control over their private keys, and, consequently, their funds. This means that only the user can initiate and authorize transactions or access the coins, emphasizing the adage “not your keys, not your crypto”.

Conversely, custodial wallets entail entrusting a third party, such as a crypto exchange, with the private keys. The exchange executes transactions on the user’s behalf, which could be seen as a relinquishment of some control for the sake of convenience and assistance.

User Experience and Access in Non-Custodial Wallets vs Custodial Wallets

User experience is vastly different between the two wallet types. Non-custodial wallets require a higher degree of user involvement. They are preferable for those who are tech-savvy and want to maintain full authority over their crypto assets. On the other hand, custodial wallets simplify the experience by managing the technical aspects of the wallet, making it suitable for beginners or those less inclined towards technological management.

It’s important to note that with custodial services, users can recover access to their assets if they forget their login credentials, unlike with non-custodial options where losing key information can result in irretrievable loss of assets.

Security Implications of Non-Custodial Wallets vs Custodial Wallets

Security considerations are paramount. Non-custodial wallets offer a high level of security since the user solely controls the private keys. This minimizes the risk of platform-wide breaches but increases personal responsibility for security practices.

On the flip side, custodial wallets are inherently at a higher risk for targeted hacks because they possess a large number of users’ private keys. They often implement rigorous security measures, but the centralized nature of custody makes them a more lucrative target for cyber attacks.

Key Takeaways for Non-Custodial Wallets vs Custodial Wallets: Definition

- Non-custodial wallets offer complete control and responsibility for security to the user.

- Custodial wallets provide convenience at the cost of surrendering direct control over funds.

- User experience differs with non-custodial options offering more control and custodial ones offering ease of use, especially for beginners.

- Security risks vary, with non-custodial users needing to be vigilant about personal security practices, while custodial wallet providers must safeguard against external threats.

Comparison Chart: Non-Custodial vs Custodial Wallets

| Features | Non-Custodial Wallets | Custodial Wallets |

| Control over Private Keys | Full user control | Controlled by a third party |

| User Responsibility | High – users must safeguard keys | Low – managed by service provider |

| Ease of Use | Requires more technical knowledge | Beginner-friendly, less user involvement |

| Risk of Hacks | Lower – as the keys are not stored in a centralized database | Higher – because a third-party website could be hacked |

| Recovery Options | Limited – if keys are lost, funds may be irrecoverable | More options – password can be reset through service provider |

Smartlink’s Escrow and Multi-Currency Approach to Wallet Security

Reinforcing Transaction Security with Smartlink’s Escrow System

In the cryptocurrency domain, where the debate of Non-Custodial Wallets vs Custodial Wallets plays a critical role, Smartlink carves its niche by providing a robust escrow service. This ensures that all parties remain protected during transactions.

By acting as a neutral third party, Smartlink’ Smart-Contracts hold the cryptocurrency in escrow, only releasing funds when all the predefined conditions of the transaction have been met.

This process significantly reduces the risk of fraud and increases trust between parties, a sought-after assurance in the crypto world. Such a system also aligns well with non-custodial wallets where security and autonomy are paramount, as users retain control over their private keys while benefiting from the additional layer of security during transactions.

Key Advantages of Using Smartlink Escrow

- Enhanced Security: Offers peace of mind through secured transaction processing.

- User Autonomy: Aligns with the philosophy of non-custodial wallets ensuring users have control over their assets.

- Trust Facilitation: Builds trust in digital transactions with a system that upholds the integrity of the transaction process.

Smartlink Escrow Mechanism Overview

| Step | Description |

| 1. Agreement | Both parties agree on transaction conditions and start the process. |

| 2. Asset Hold | Smart-Contracts hold the assets in the escrow account securely. |

| 3. Condition Fulfillment | Once conditions are met, the transaction is authorized and completed. |

Facilitating Multi-Currency Transactions on Smartlink

Expanding the utility and accessibility of crypto wallets, Smartlink’s multi-currency capabilities are vital in today’s eclectic cryptocurrency landscape. Both non-custodial and custodial wallets benefit from Smartlink’s support for leading cryptocurrencies. This broad support empowers users with flexibility and freedom in their payment options, essential features for modern digital transactions.

It ensures that irrespective of the users’ wallet preferences, whether it is toward the non-custodial wallets that offer full control or custodial wallets that manage the keys, Smartlink’s platform can cater to their needs seamlessly.

Advantages of Multi-Currency Support

- Flexibility in Payments: Enables users to transact with different cryptocurrencies.

- Wider Acceptance: Broadens the scope of transactions by accepting various digital assets.

- Enhanced User Experience: Provides a more inclusive platform for diverse crypto preferences.

Comparing Smartlink’s Multi-Currency Support

| Feature | Advantage |

| Multi-Currency | Supports multiple cryptocurrencies enhancing user choice. |

| Non-Custodial Compatibility | Works with non-custodial wallets, resonating with the ethos of crypto’s self-sovereignty. |

| Seamless Integration | Can be easily integrated with various eCommerce platforms and crypto services. |

Ensuring Flexibility and Security with Smartlink’s Unique Offerings

In the ever-evolving landscape of Non-Custodial Wallets vs Custodial Wallets, Smartlink emerges as a solution that blends flexibility with uncompromised security. By providing escrow services and support for numerous cryptocurrencies, Smartlink offers a platform that not only caters to the technical demands of various digital asset holders but also upholds the core values of the crypto community—control, security, and freedom of choice.

As users navigate the complexities of digital transactions, Smartlink stands as a beacon of trust, efficiency, and innovation in the wallet security space.

Choosing Your Crypto Wallet with Smartlink: A Practical Guide

Understanding Non-Custodial Wallets vs Custodial Wallets: Definition and Differences

When venturing into the world of cryptocurrency, one of the most critical decisions you will make is the type of wallet to use. The debate between Non-Custodial Wallets vs Custodial Wallets and features are essential to consider. Non-custodial wallets offer complete control over your private keys and, consequently, over your funds. This means you are solely responsible for the security and management of your assets. On the other hand, custodial wallets are managed by third-party services like exchanges, where they take care of the private keys.

While they may be more user-friendly, especially for beginners, they come with the downside of having another party in control of your funds, making them potentially vulnerable to security breaches. Smartlink endorses the empowerment and security that comes with non-custodial solutions, giving users peace of mind knowing their digital assets are under their control.

Evaluating the Pros and Cons of Wallet Types

When determining which wallet works best for you, it’s imperative to balance the advantages against the potential drawbacks. Custodial wallets shine with their simplicity and ease of use. They require less technical know-how and usually provide means to recover your account if login credentials are lost. However, this convenience can come at the cost of decreased security and privacy due to the custodian’s control over your private keys.

Alternatively, non-custodial wallets, encouraged by Smartlink, permit unparalleled sovereignty over your cryptocurrency. They necessitate a higher degree of responsibility for safeguarding your keys but offer the security of knowing that you are not as exposed to custodial risks like exchange hacks or fund misappropriation.

Smartlink’s Approach to Empowering Users with Non-Custodial Options

Smartlink advocates for the empowerment of users through non-custodial wallet options. Operating with a Non-Custodial Wallet in mind, Smartlink upholds the philosophy of self-sovereignty in the digital assets space. The platform provides tools and resources that help users become adept at managing their non-custodial wallets, featuring enhanced security protocols and user-oriented services. By choosing a non-custodial wallet via Smartlink, you’re not just opting for a secure storage method but are also embracing the broader ethos of blockchain’s decentralization, keeping your digital currencies out of reach from unauthorized access and centralized control.

Comparative Table: Custodial vs Non-Custodial

| Features | Custodial Wallet | Non-Custodial Wallet |

| Control Over Keys | Third-party | User |

| Ease of Use | High (user-friendly) | Varies based on user expertise |

| Security | Lower (risk of centralized control) | Higher (user-managed security) |

| Account Recovery | Typically available | Dependent on personal backup solutions |

Choosing the Right Wallet for Your Needs

- Evaluate your technical comfort and knowledge level.

- Consider the importance of having complete control over your finances.

- Balance the value of convenience against the need for tight security.

- Understand the responsibility associated with managing private keys.

Frequently Asked Questions About Wallet Choices

Users often inquire about the practical aspects of choosing between Non-Custodial Wallets vs Custodial Wallets and application in everyday crypto dealings. When it comes to non-custodial wallets, Smartlink frequently addresses questions about key management, wallet security, and backup processes. For those leaning towards custodial options, questions tend to center around trust in the custodian, the process of retrieving lost credentials, and the potential for fund recovery in case of a compromise. Smartlink’s resources aim to educate and guide users in making informed decisions based on their personal preferences and risk tolerance.

FAQ – Questions

What Are the Key Security Differences Between Non-Custodial and Custodial Wallets?

Non-custodial wallets provide users full control over their private keys, which means the user has exclusive access to their funds. Examples include hardware wallets like Ledger Nano X, where the user keeps the device that stores the keys. In contrast, custodial wallets have a third-party service provider managing the private keys. Services like Coinbase and Binance are custodial, with the provider safeguarding the keys, potentially creating a central point of failure. However, these services often have robust security measures and insurance to mitigate risks.

Can I Convert Between Non-Custodial and Custodial Wallets Easily?

Yes, transferring funds between non-custodial and custodial wallets is typically straightforward. For example, you can send Bitcoin from a Trezor (non-custodial) to a wallet on Kraken (custodial) by generating a deposit address on Kraken and executing a transfer. The reverse is also true, allowing flexible asset management across different wallet types. However, always verify addresses and transaction details carefully to avoid errors.

How Does User Experience Differ Between These Wallet Types?

The user experience in non-custodial wallets often requires more technical know-how but offers greater autonomy and privacy. Wallets like MyEtherWallet grant users direct interaction with blockchain networks, requiring them to manage their security practices. On the other hand, custodial wallets provide a more user-friendly experience, resembling traditional banking apps, with companies like PayPal offering streamlined interfaces and customer support, thus lowering the barrier to entry for new users.

What are the Implications of Regulatory Compliance on Wallet Choices?

Regulatory compliance affects both wallet types differently. Non-custodial wallets, such as MetaMask, grant users anonymity and can operate with less regulatory oversight, which might appeal to users in regions with strict financial controls. Custodial wallets, like those provided by Gemini, must adhere to Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, offering increased accountability and often leading to higher trust among users who prefer regulated financial services.

Are There Cost Differences When Using Non-Custodial vs. Custodial Wallets?

Cost implications vary based on wallet types. Non-custodial wallets may incur network fees for transactions but generally do not have custodial fees. For example, using an Electrum wallet will only require you to pay blockchain network fees. Custodial wallets may introduce service fees for added features like currency exchange or withdrawal to fiat, as seen with BitGo, where users pay for additional security and convenience services. Always review fee structures to ensure they align with your usage patterns.

In the dynamic world of digital assets, choosing between non-custodial and custodial wallets is a crucial decision for any crypto enthusiast. With security and accessibility at the forefront, educating yourself on the nuances of each wallet type can greatly impact your cryptocurrency journey. As you continue to navigate through the complexities of blockchain custody, remember that the control you desire over your funds should align with your technical comfort level and risk tolerance. Explore further to understand how Smartlink’s innovative solutions can serve your needs, and shape your own approach to managing digital assets securely and efficiently.

Share this article