Demystifying Escrow Payment: A Comprehensive Guide

Demystifying Escrow Payment: A Comprehensive Guide

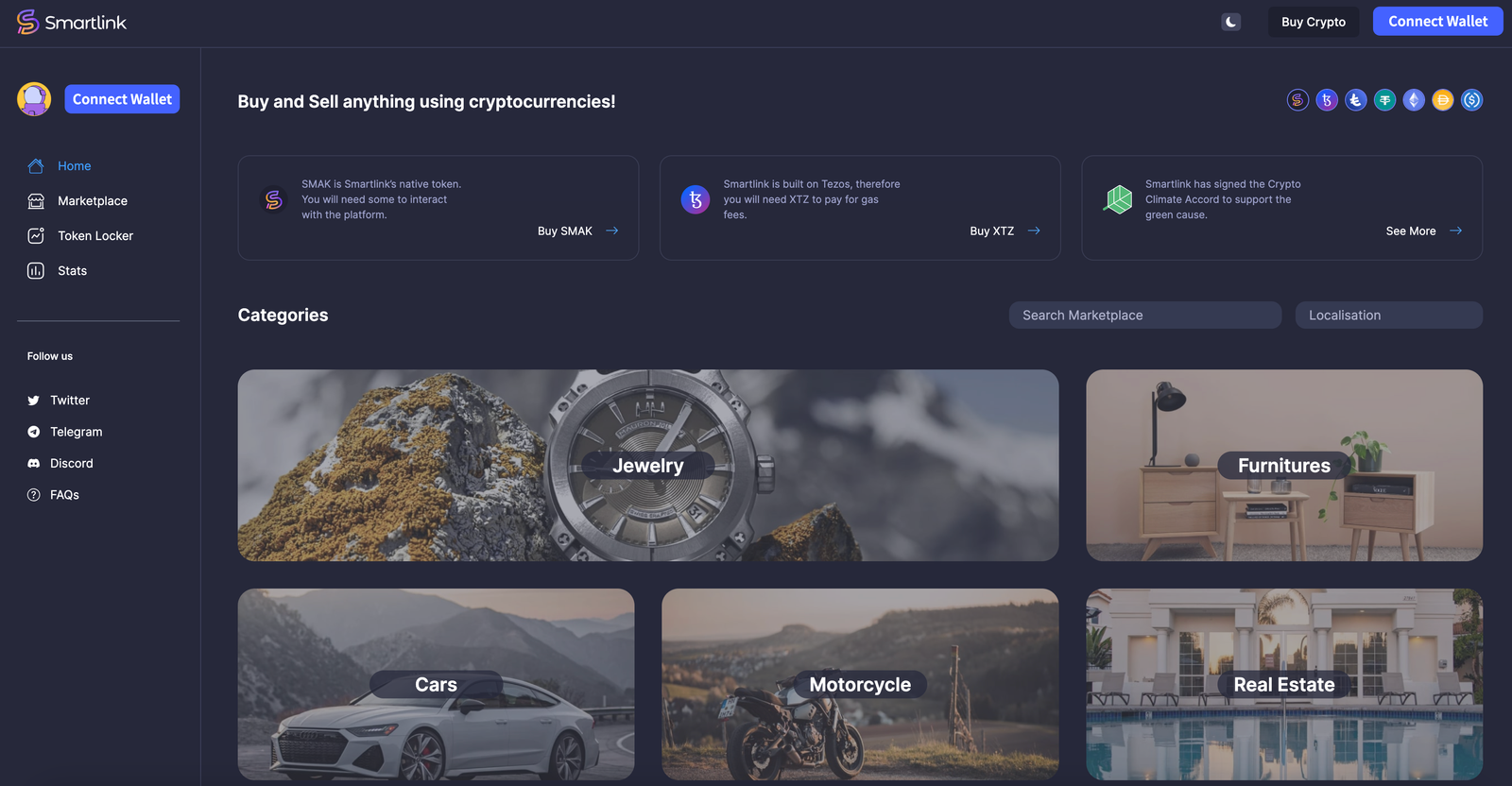

Smartlink

Trust-as-a-Service for the global marketplace

Navigating the complexities of escrow payments just got a whole lot simpler with Smartlink’s comprehensive yet user-friendly guide. This essential walkthrough promises to bridge the gap between understanding and executing secure transactions, ensuring users remain confident throughout the process. Whether you are a first-time user or looking to refine your knowledge, this guide serves as your trusty companion in mastering the art of escrow payments. Unpack the layers of security, dive into streamlined procedures, and unlock the potential of safe online exchanges, with insights tailored to enhance your digital transaction experience.

Exploring the Benefits of Escrow Services in Crypto Transactions

Increased Transactional Security and Trust

When it comes to digital financial transactions, security is paramount. Escrow services play a critical role in reinforcing trust between transacting parties. By using an escrow account to hold funds until the fulfillment of specific conditions, both buyers and sellers have peace of mind. To demystify what’s in an escrow account, consider it as a neutral third-party holding area that is only released when contractual obligations are met. This layer of security is particularly crucial in the volatile realm of cryptocurrency transactions, where the irreversible nature of blockchain can often be a double-edged sword.

Enhanced Protection Against Fraud

Crypto markets, though innovative, are rife with fraudulent schemes. Escrow services could answer the pressing question: “How does escrow work to minimize fraud?” By verifying each transaction’s legitimacy and holding funds securely, escrow services significantly reduce the risk of scams. Funds are disbursed only when both parties are satisfied that their conditions have been met, rendering the transaction transparent and securing against dishonest practices.

Objective Conflict Resolution

In the event of disputes, escrow payments offer an impartial resolution mechanism. An escrow service provider can act as an adjudicator to ensure fair treatment for all parties involved. This process adds an extra layer of trust and accountability to crypto transactions, diminishing fears related to fraud or breaches of agreement.

Bridging the Trust Gap in Decentralized Transactions

In a decentralized digital ecosystem, trust is both scarce and precious. Demystifying Escrow Payment: A Comprehensive Guide suggests that escrow services bridge this trust gap significantly. Users wondering “What does escrow mean?” should view it as synonymous with a non-custodial safeguard in transactions that offer extra assurance, essential in a space known for its anonymity and lack of recourse. By delivering trust in a trustless environment, escrow services facilitate a user-friendly path for wider adoption of crypto transactions.

Supporting Consumer Confidence

The growth of digital currencies hinges on consumer confidence, which is bolstered by the certainty that escrow services provide. As a risk mitigation tool, escrow accounts ensure that consumers can engage in crypto transactions without the fear of losing their assets to unsecured processes.

Facilitating International Trade and Transactions

Cryptocurrency is inherently international, eliminating the need for traditional currency exchange. However, international transactions involve inherent risks and complexities. Escrow services provide an effective solution here too. For instance, in international trade, what are escrow payments if not a guarantee that goods and services will be delivered as promised and payments will be made as agreed? This global approach enables smoother and more reliable transactions across borders, promoting cross-border commerce with less concern for misunderstandings or misrepresentations.

Transactional Versatility Across Currencies

Multi-currency support in escrow services offers flexibility and convenience for global trade participants, allowing them to transact in various cryptocurrencies without worrying about currency exchange risks. This versatility makes escrow services an indispensable tool for modern digital commerce.

Maximizing Flexibility with Multi-Currency Escrow Solutions

Understanding the Multi-Currency Approach in Escrow Transactions

Escrow services are evolving to meet the demands of a globalized economy. With business transactions crossing borders more frequently, the ability to deal with multiple currencies becomes a necessity. Smartlink’s escrow payment solution adopts a multi-currency approach, which allows users to send and receive funds in several leading cryptocurrencies. This flexibility not only caters to a diverse client base but also ensures that transactions can be completed without the hassle of currency conversion, providing smoother and more efficient transaction flows. By demystifying escrow payments and broadening accessibility, Smartlink is creating a comprehensive guide to a secure financial future.

Key Benefits of Multi-Currency Support

- Simplifies international transactions by removing currency barriers.

- Enhances transaction speed as currency exchange time is eliminated.

- Offers better control over currency fluctuation risks.

- Expands market reach by appealing to a global audience.

How Multi-Currency Escrow Services Enhance Security

The underlying premise of any escrow account is security. By implementing a multi-currency escrow solution, Smartlink ensures that the integrity of each transaction is maintained regardless of the currency used. This feature provides an additional layer of protection against fraud, as the escrow service acts as a neutral third party holding the funds until the agreed conditions are fulfilled. Plus, with the transparency inherent in blockchain technology, parties in a transaction can track their funds in real time, fostering trust and reducing uncertainty in what does escrow mean for their business.

Comparative Analysis: Traditional vs. Crypto Escrow Security

| Aspect | Traditional Escrow | Crypto Multi-Currency Escrow |

| Transparency | Limited | High |

| Speed | Can be slow due to banking processes | Instantaneous with blockchain confirmation |

| Security | Depends on the institution’s integrity | Secured by decentralized blockchain protocols |

| Fees | Often high due to intermediaries | Lower, due to the absence of traditional intermediaries |

Facilitating Global Commerce with Escrow Payment Solutions

In the modern digital economy, escrow services like Smartlink are not just a convenience—they are a necessity for global commerce. Multi-currency support in escrow payments breaks down financial barriers, allowing businesses to tap into new markets with confidence. The use of leading cryptocurrencies ensures that no matter where the buyer or seller is located, or what are escrow payments to them, the transaction can occur swiftly, securely, and without unnecessary fees. This capability empowers businesses to take control of their international growth, making Smartlink an essential component in the toolkit for global trade.

Frequently Asked Questions About Multi-Currency Escrow

What is in an escrow account when dealing with multiple currencies?

An escrow account holds the funds during a transaction and can contain various cryptocurrencies, which are released once transaction conditions are met.

How does escrow work with cryptocurrencies?

Crypto escrow processes are similar to traditional ones but leverage blockchain for enhanced security and transparent contract execution.

Future-Proofing Financial Transactions with Smartlink Innovation

Demystifying Escrow Payment: Embracing Blockchain for Secure Exchanges

As the digital marketplace continues to expand, the security and reliability of online transactions remain paramount. Smartlink emerges as a game-changer, offering breakthrough solutions in the form of escrow payments. By integrating blockchain technology, Smartlink addresses the evergreen question of what is in an escrow account?, ensuring that assets are securely locked until all parties fulfill their contractual obligations. This innovative approach not only solidifies trust between parties but also heralds a new era where how does escrow work? is answered with robust security and transparent processes. With such a system, Smartlink paves the way for future-proof financial transactions that cater to the rapidly evolving needs of the digital economy.

Anticipating the Future of Decentralized Finance

The trajectory of decentralized finance (DeFi) suggests an unstoppable march towards a future where conventional financial intermediaries are no longer the gatekeepers. Smartlink is at the vanguard of this movement, redefining what does escrow mean? in the context of DeFi. Its forward-thinking escrow service exemplifies how does escrow work in an increasingly decentralized world, establishing secure, autonomous transactions that are not just a fad but the bedrock of future commerce. As we stand on the precipice of this financial revolution, Smartlink is not merely answering questions but is actively writing the next chapter of the digital transactions narrative.

Ensuring Adaptability and Compatibility with eCommerce Platforms

- Seamless integration with online marketplaces

- User-friendly interface promoting widespread adoption

- Enhanced shopping experience with secure transaction gateways

Community Engagement and Continuous Platform Evolution

- Active collaboration with a robust Smartlink user community

- Regular updates with the introduction of cutting-edge blockchain features

- Comprehensive guides and support to empower users

Market Analysis and Forecasting Technological Trends

| Year | Trends | Smartlink’s Evolution |

| 2021 | Escrow becomes an essential feature of online transactions | Smartlink introduces blockchain-based escrow services |

| 2022 | Rise of multi-currency platforms | Smartlink expands currency support, integrating major cryptocurrencies |

| 2023 and beyond | DeFi redefines financial transactions | Smartlink leads with innovative escrow payment solutions and DeFi integration |

FAQ – Questions

What is an escrow payment?

An escrow payment is a financial arrangement where a third party holds and regulates payment of the funds required for two parties involved in a given transaction. For example, in online marketplaces, Smartlink may hold funds in escrow until the buyer confirms receipt of the item, ensuring a secure and trustworthy transaction.

How does Smartlink ensure the security of transactions?

Smartlink leverages blockchain technology to secure transactions, creating an immutable record of the agreement and the payment. This means once terms are met, the automated smart contract executes the payment, preventing fraud and errors. It’s akin to a digital safe-deposit box, protecting all parties involved.

Can escrow payments be beneficial for small businesses?

Absolutely. Small businesses can greatly benefit from escrow payments, as they ensure that payment is received for services or goods provided before final transfer. For instance, a freelance graphic designer may use Smartlink to hold payment for a project until it is delivered to and approved by the client.

What types of transactions are best suited for escrow?

Escrow is exceptionally well-suited for high-value transactions, online purchases, real estate deals, and freelance services. For instance, in real estate, escrow ensures that the property and its title transfer only occur when all conditions of the sale are met, protecting both buyer and seller.

How is the escrow payment released to the seller?

The escrow payment is released to the seller after the buyer inspects and approves the received product or service. For example, in a Smartlink transaction, once the buyer verifies the condition of a used car and all stipulated requirements are fulfilled, the funds are released from escrow to the seller automatically.

In harnessing the full potential of escrow payments, Smartlink’s guide demystifies the process, ensuring your monetary transactions are secure and straightforward. As you embrace the future of financial dealings, remember that knowledge is power—empowering you to transact with confidence. Step confidently into a world where financial safety aligns seamlessly with user experience, powered by Smartlink’s innovative approach.

Share this article