Crypto Escrow Payment Processor Essentials: A Comprehensive Overview

Crypto Escrow Payment Processor Essentials: A Comprehensive Overview

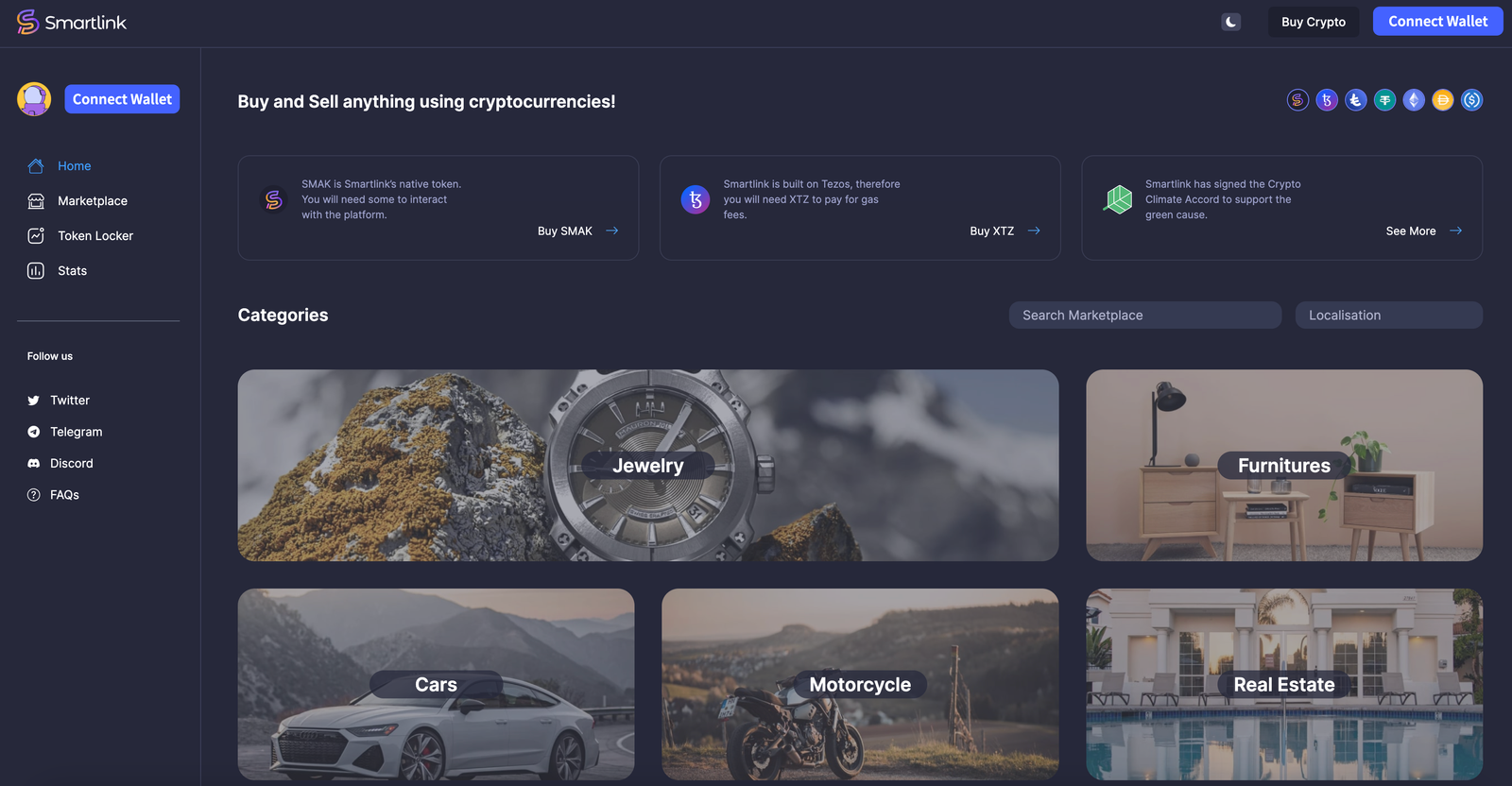

Smartlink

Trust-as-a-Service for the global marketplace

Smartlink emerges as an innovative solution in today’s fast-evolving cryptocurrency landscape, transforming how escrow payments are managed and secured. With the surge of digital transactions, both individuals and businesses seek reliable methods to facilitate secure, trust-free exchanges. This guide delves into the intricacies of utilizing Smartlink for escrow services, offering a seamless bridge between traditional payment safety and cutting-edge blockchain technology. Dive into the workings of Smartlink and unlock the potential of crypto escrow systems to empower your transactions with unmatched security and efficiency.

Enhancing Digital Security: How Smartlink Revamps Escrow Payments for Cryptocurrency

Crypto Escrow Payment Processor Essentials: A Comprehensive Overview of Smartlink’s Security Framework

Smartlink is redefining digital security in the cryptocurrency sphere with its innovative escrow payment solutions. By leveraging cutting-edge blockchain technology, Smartlink ensures that every transaction is encrypted and tamper-proof, fostering trust among users. The platform’s non-custodial approach means that funds are not held by a central authority but by a secure smart contract until the agreed-upon conditions are met. This level of security is vital in mitigating risks such as fraud and default, which are prevalent in online transactions. Notably, the crypto escrow payment processor essentials hinge on transparent procedures that guarantee fairness for all parties involved—buyers, sellers, and service providers alike.

Multi-layered Security Protocols in Escrow Transactions

Smartlink’s commitment to security extends beyond basic encryption. By integrating a multi-layered security protocol system, the platform provides additional protection against unauthorized access and cyber threats. This includes multi-signature wallets requiring multiple approvals before funds can be released, thus ensuring that transactions are processed only when all parties are satisfied. Additionally, the platform’s regular security audits and compliance checks contribute to the overarching safety measures, safeguarding users’ assets and personal information incessantly.

Real-Time Monitoring and Conflict Resolution

An integral part of Smartlink’s escrow service is its real-time monitoring system. It allows for immediate detection and mitigation of any unusual activity, providing an extra layer of security. Furthermore, Smartlink has ingrained a dispute resolution mechanism that affords users the ability to resolve conflicts efficiently, without compromising the integrity of the escrow process. The system is designed to be fair, unbiased, and swift, reinforcing the platform’s commitment to providing a secure and stable environment for cryptocurrency exchanges.

Key Security Measures

- Advanced blockchain technology for secure transactions.

- Non-custodial smart contracts to hold funds.

- Multi-signature wallets for controlled fund release.

- Regular audits and compliance checks for ongoing security assurance.

- Real-time monitoring to detect and prevent fraudulent activities.

- Efficient and fair dispute resolution framework.

Security Enhancements Through User Experience

In the realm of crypto escrow payment processors, user experience and security go hand-in-hand. Smartlink has meticulously designed its platform to be user-friendly while upholding robust security measures. The simple and intuitive interface masks the complex security operations that function seamlessly in the background. By doing so, Smartlink empowers even those with little to no technical knowledge to engage in secure cryptocurrency transactions, thereby expanding the reach of digital currency use securely and responsibly.

Comparison Table: Traditional vs. Smartlink Escrow Security

| Feature | Traditional Escrow | Smartlink Escrow |

| Fund Custody | Held by third-party | Secured by smart contract |

| Transaction Security | Basic encryption | Blockchain encryption and multi-signature wallets |

| Dispute Resolution | Often lengthy and biased | Efficient, unbiased, and built into the platform |

Beyond simply managing transactions, Smartlink paves the way for more trustworthy digital trade by enhancing the security and integrity of escrow services in the world of cryptocurrency. With a firm foundation in security and an eye toward the future, it is poised to revolutionize the way we think about and conduct online transactions.

Smartlink’s Multi-Currency Support: Facilitating Global Crypto Transactions

The Flexibility of Multi-Currency Transactions

In the realm of digital finance, the ability to transact in multiple cryptocurrencies is no longer a convenience but a necessity. Smartlink recognizes this imperative and offers robust multi-currency support, creating a genuinely global crypto escrow payment processor platform. With support for leading cryptocurrencies like Ethereum (ETH), Polygon (MATIC), USDT, USDC and many others, Smartlink ensures that users are not limited by currency barriers. This approach not only enhances flexibility for users but also fosters inclusivity, allowing anyone, anywhere, to participate in secure transactions without the worry of currency conversion.

Key Advantages of Smartlink’s Multi-Currency Support

- Broad Access: Engage with an international audience by accepting a wide range of digital currencies.

- Reduced Conversion Fees: Minimize expenses related to currency exchange, enhancing transaction cost-effectiveness.

- Market Adaptability: Stay ahead of the curve by accommodating emerging cryptocurrencies and adapting to market trends.

Understanding Smartlink’s Currency Integration

Through its user-oriented platform, Smartlink also streamlines the process of integrating multiple currencies into a single transaction flow. This means that businesses and individuals can manage a diversified portfolio of cryptocurrencies effortlessly. When using Smartlink, concerns about technical complexities dissipate, as it presents an efficient, secure, and straightforward gateway to accept and manage crypto assets as a part of a broader financial strategy.

Empowering E-Commerce with Cryptocurrency Acceptance

E-commerce platforms stand to gain significantly from Smartlink’s multi-currency capabilities. By integrating Smartlink’s crypto escrow payment processor into their payment systems, online merchants can effortlessly expand their customer base to those who prefer wielding digital currencies for their transactions. This seamless integration positions Smartlink as a forward-thinking solution within the Crypto Escrow Payment Processor Essentials: A Comprehensive Overview narrative, allowing e-commerce businesses to embrace the crypto revolution confidently and securely.

Charting the Impact on Online Merchant Sales

| Feature | Benefit |

| Multi-Currency Acceptance | Captures a broader market of crypto users |

| Escrow Security | Builds trust with customers |

| Integration Ease | Saves time and resources for businesses |

Building a Community Around Secure Crypto Commerce

Finally, the inclusivity fostered by Smartlink’s multi-currency support transcends pure transactional benefits. It cultivates a diverse community of users, ranging from crypto enthusiasts to merchants looking for a reliable crypto payment processor. Within this community, Smartlink isn’t just an escrow service but also serves as the glue that binds together actors from various sectors, resulting in a collaborative ecosystem underpinned by transparency, security, and trust.

Navigating the Future of Finance with Smartlink

Embracing Blockchain for Enhanced Escrow Security

In the evolving landscape of finance, security remains a paramount concern, especially when it comes to online transactions. Smartlink harnesses the immutable nature of blockchain technology to redefine escrow services. By acting as a decentralized Crypto Escrow Payment Processor, Smartlink ensures that transactions are not only transparent but also secure against fraud. Utilizing smart contracts, Smartlink holds funds in escrow until agreed-upon conditions are met, thus providing an essential layer of trust in digital dealings. This approach mitigates the common risks associated with online payments, enabling a more secure future for finance.

Key Features of Smartlink’s Escrow Services

- Decentralized security against fraud and unauthorized access

- Automated execution of contractual obligations with smart contracts

- Transparent transaction records on the blockchain, enhancing trust

Understanding Smartlink’s Smart Contracts

| Element | Description |

| Smart Contracts | Self-executing contracts with terms directly written into lines of code |

| Transparency | All parties can view the terms and status of the escrow transaction |

| Security | Blockchain’s decentralized nature ensures protection against tampering |

| Efficiency | Automated processes reduce the time and cost of manual escrow services |

The Role of Cryptocurrencies in Streamlining Payments

The integration of cryptocurrencies in payment processes is no longer a futuristic idea but a present reality. As a leading Crypto Escrow Payment Processor, Smartlink drives innovation by supporting multiple cryptocurrencies, which offers a wide array of choices for users. This multi-currency support not only aligns with the diverse preferences of users but also paves the way for more inclusive and flexible financial operations. With cryptocurrencies at the helm, Smartlink positions itself at the forefront of the future of transactions, catering to the needs of a global audience and cutting down on traditional banking inefficiencies.

Advantages of Multi-Currency Support

- Diverse payment options tailored to user preference

- Reduction in cross-border transaction fees and time delays

- Financial inclusivity by catering to a global user base

Adopting Smartlink for Forward-Thinking Businesses

Modern businesses require modern solutions, and with the integration capabilities of Smartlink, companies can now step into the future of e-commerce with confidence. The platform’s design to seamlessly integrate with existing e-commerce systems is a game-changer. This Crypto Escrow Payment Processor capability not only simplifies the transition into using cryptocurrencies for everyday transactions but also enhances customer trust with every purchase. Smartlink is thus not just a payment processor; it’s an essential bridge to the future of finance for visionary businesses seeking to leverage technology for growth and customer satisfaction.

Implementing Smartlink with E-Commerce Platforms

- Ease of integration with popular e-commerce platforms

- Streamlined user experiences that facilitate quicker checkouts

- Building consumer trust with secure and transparent transactions

FAQ – Unlocking Crypto Escrow Payments with Smartlink

What is the advantage of using Smartlink for crypto escrow over traditional services?

Smartlink offers enhanced security and transparency by utilizing blockchain technology for escrow services. By automating transactions through smart contracts, it reduces human error and the need for intermediaries. This results in lower fees and faster transaction times compared to traditional escrow services. For example, in real estate transactions, using Smartlink can streamline the process by automatically releasing funds upon the fulfillment of agreed conditions.

How does Smartlink ensure the security of transactions within its ecosystem?

Security on Smartlink is ensured through the use of decentralized smart contracts that execute automatically once predefined conditions are met. This eliminates the risk of fraud or non-compliance by either party involved in a transaction. Smartlink’s infrastructure is built on the Tezos blockchain, which is renowned for its security features, including formal verification of smart contracts, to protect against vulnerabilities and hacking attempts.

Can Smartlink be integrated with traditional payment systems?

Yes, Smartlink bridges the gap between cryptocurrency and traditional finance by enabling seamless integration with conventional payment gateways. This interoperability allows users to engage in escrow services with cryptocurrencies while still connecting to more widely-used payment systems. For instance, a user can fund an escrow transaction using their credit card, which Smartlink converts into cryptocurrency to hold in the escrow smart contract.

In what scenarios is using Smartlink particularly beneficial for escrow?

Smartlink is particularly beneficial in industries where trust and verification are paramount. For example, in online marketplaces, Smartlink can ensure that payment is only released when goods are delivered and validated by the buyer, effectively preventing scams. In freelancing platforms, it guarantees that freelancers get paid upon project completion without the need for costly and time-consuming litigation.

Are there any limitations to the types of currencies or assets that can be used with Smartlink?

While Smartlink is primarily designed to support a range of cryptocurrencies, the platform continuously evolves to accommodate various digital assets. However, the integration of certain fiat currencies or specific types of assets might be limited by regulatory compliance and the technical capabilities of the platform at any given time. As of now, Smartlink is focused on expanding support for digital assets that are commonly used and trusted within the cryptocurrency community.

Embarking on the journey of crypto escrow payments with Smartlink introduces a realm of security and efficiency for your transactions. This smart solution not only mitigates risk but also streamlines the payment process, proving to be a game-changer in digital trade. By leveraging the power of blockchain, Smartlink provides an unassailable platform for both senders and receivers. Stay ahead of the curve and explore the full potential of crypto escrow through our comprehensive guide, unlocking a world of opportunities in the evolving blockchain landscape.

Share this article